We Do

Mortgages.

Get approved for your home loan by a loan officer near you.

Apply NowWe Are Local.

UMortgage LOs have a focus on serving their local communities while also having a nationwide reach that's rapidly growing.

You've Got Q's, We've Got A's.

Mortgage

What Are Seller Concessions? A Simple Guide for Homebuyers and Sellers

Market Update, Mortgage

How the Federal Reserve Impacts Mortgage Rates (And How It Doesn't)

Purchase

How to Seamlessly Sell Your Current Home and Buy Your Next One

News, Mortgage

The CFPB’s Role in the Homebuying Process

Mortgage Planning Made Easy.

Our easy-to-use calculators help you estimate and optimize your mortgage solutions.

Find your monthly payment.

What does a monthly mortgage payment look like for you? Get an estimate with some basic information.

Estimated Monthly Payment

$0 /mo

The UMortgage mortgage calculators are for estimation purposes only. This is not a commitment to lend. For an exact quote based on your individual financial circumstances, please contact us.

Experience is

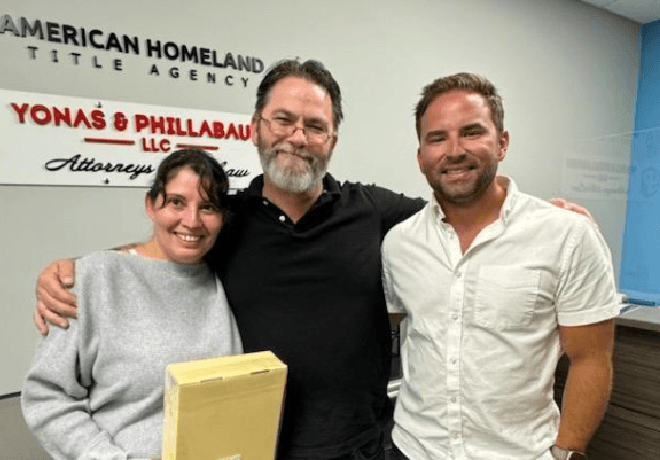

Everything.

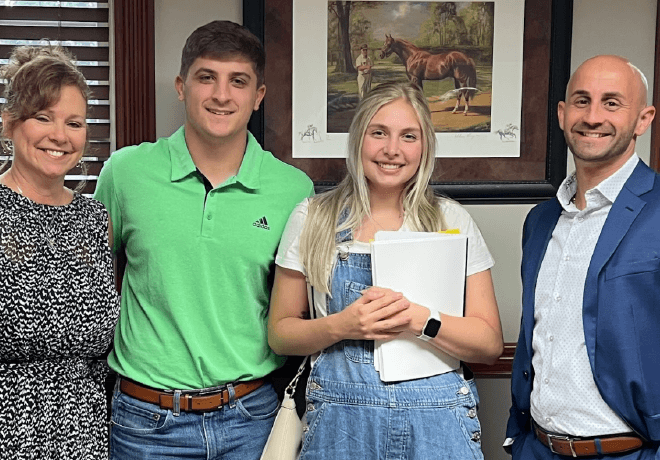

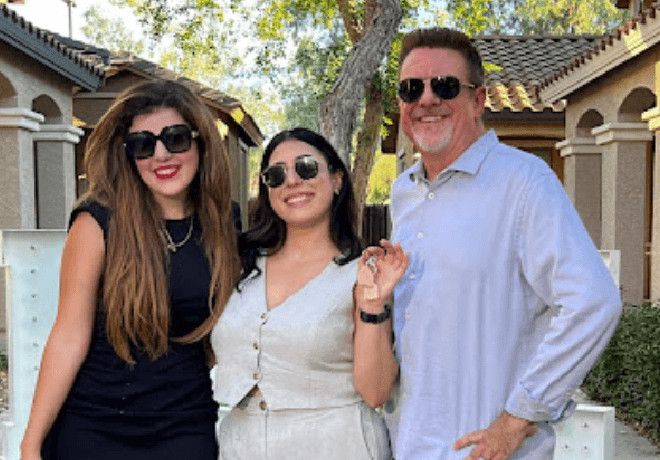

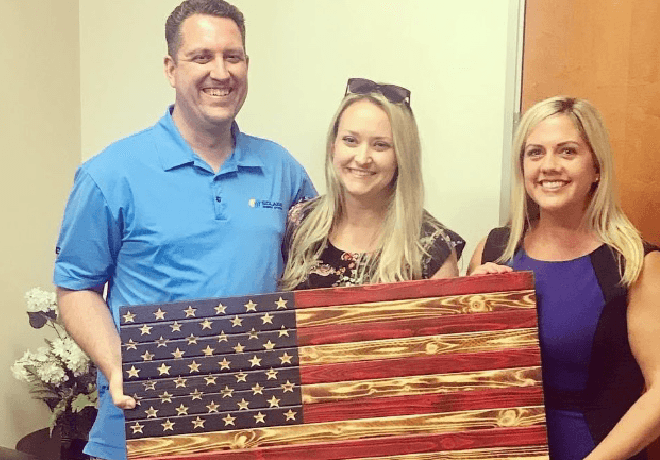

If an industry leading 95 Net Promoter Score isn't enough, take it from borrowers that have worked with us.

Kristy Lynn

David is absolutely wonderful! He made this entire process in getting a VA Loan as simple as it could have possibly been for my first mortgage! I have and will continue to recommend him to every Veteran I know. Thank you for everything, David.

Raymond Gummer

I had a difficult mortgage due to county issues etc. Fortunately I also had the best people working for me. You'll never regret a moment having Corey on your side. He's so dedicated to the customer, keeps you up-to-date on everything, and is just one hell of a guy. I have my first home because Corey made it happen, and I couldn't thank him enough. This guy is truly top of his game and I'm blessed to have had him on my team.

Susan Lenhardt

I can't say enough good things about Vinnie. If you want someone that contacts you right away and is there for you and your buyers the entire time through the whole process then you have to talk to Vinnie and see for yourself. My buyers are always very pleased with his professionalism and efficiency. He definitely goes the extra mile for them. They appreciate it and so do I.

Dominique Bell

Nicole was an absolute pleasure to work with! From the first conversation we had I knew we were going to be a great team for our buyer. She is thorough and communicates each step throughout the entire process up until closing day and she got my buyer $10k in grants! Thank you Nicole for all your hard work!

Yuritt Pasos

Brian and his team are amazing. From the first time I met Brian, he took the time to explain every step of the process with great patience and knowledge. I can honestly say I never expected for this process to feel so easy but Brian made it possible. I will always be thankful for all the support provided.

Meredith Smith

My family had a fantastic experience with Sunnie! Extremely capable and supportive, she helped us through the whole process with ease and a personal touch. We can't thank her enough! Even years after we closed our home, she still provides us with advice and encouragement. Thank you Sunnie!

Miranda Adams

I went through UMortgage using a VA home loan, and the agents I worked with were amazing! They worked all hours to help us get into a house and we were able to close in under 30 days! Amazing communication from both team members involved, Melly and Andy. They really made the difference in us being able to buy our first home. Huge thank you to the UMortgage team!

Nathalie Montes

I’ve had the pleasure of working with Lisa over the past year, and I can confidently say she is one of the best lenders in the industry. Her expertise with a wide range of loan products and dedication to finding the best solutions for my clients truly set her apart. Lisa goes above and beyond to secure excellent rates while ensuring a smooth, professional, and timely process from start to finish. If you’re looking for a knowledgeable, responsive, and trustworthy lender, Lisa is the one to call! I look forward to continuing our partnership and highly recommend her to anyone in need of a top-notch mortgage expert.

Become a

Confident

Buyer.

Get expert mortgage and local real estate market advice all in one. We support your VA loan process every step of the way.

Explore More ResourcesWho is UMortgage?

UMortgage is a national mortgage company that connects you with experienced mortgage brokers in your area. UMortgage's local Loan Officers use UMortgage's vast portfolio of lenders and loan products to ensure you get the most affordable mortgage possible that is tailored to your individual financial needs and homeownership goals.

How does a mortgage work?

A mortgage is a loan used to buy a home, with the house serving as collateral until the loan is repaid. You make monthly payments that cover both the loan amount and interest across the life of the loan, which most commonly spans between 15-30 years.

How do I get pre-approved?

Getting pre-approved with UMortgage is easy! You can get connected with a local UMortgage Loan Officer who will do all the heavy lifting for you by filling out some basic information in this form.

How do I find out how much I can spend on a home?

Your UMortgage pre-approval will provide you with an accurate estimate of your buying power to help you shop for homes within your budget. You can use our free affordability calculator for a more general estimate of your budget.

What are the benefits of working with a UMortgage Loan Officer?

UMortgage's Loan Officers help you access the most affordable mortgage by shopping for the lowest rate on your behalf and offering a mortgage specifically tailored to your financial needs. UMortgage prides itself on its exceptional customer experience—exemplified by our industry-best 95 Net Promoter Score—and guides you through the homebuying process & beyond with care.

What types of mortgages does UMortgage offer?

UMortgage offers expert services for all the major mortgage types: Conventional, FHA, VA, USDA, and Jumbo Loans. UMortgage also offers rate & term refinances, cash-out refinances, VA IRRRLs, and FHA Streamlines. Get connected with a UMortgage Loan Officer to learn what type of mortgage will set you up for long-term financial success.

How long does it take to get a mortgage with UMortgage?

Turn times vary from client to client, but UMortgage proudly gets clients from loan application (after you've had an offer accepted on a home) to the closing table in 2 weeks. You can read this blog for more insight into UMortgage's homebuying process.